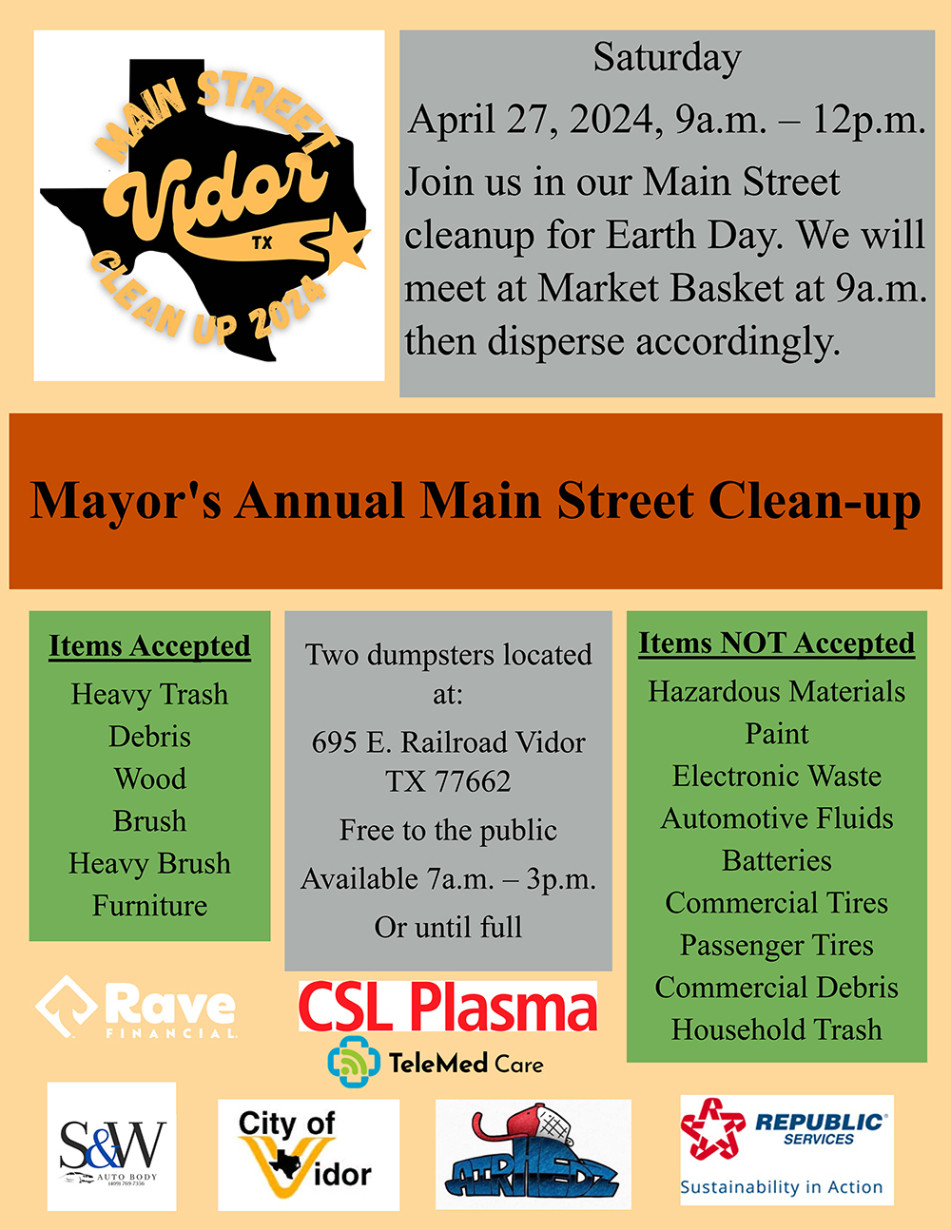

Please join us in this beautification event for our City. We look forward to seeing you there!

- Heavy Trash

- Debris

- Wood

- Brush

- Heavy Brush

- Furniture

Items NOT Accepted:

- Hazardous Materials

- Paint

- Electronic Waste

- Automotive Fluids

- Batteries

- Commercial Tires

- Passenger Tires

- Commercial Debris

- Household Trash

Two dumpsters located at: 695 E. Railroad Vidor TX 77662 - Free to the public Available 7a.m. — 3p.m. Or until full